Why Do You Need a Certified Public Insurance Adjuster?

Representing You and Your Property's Best Interests Every Step of the Way.

Serving the following Maryland counties: Prince George's, Howard, Anne Arundel, Charles, Montgomery, St. Mary's, and the Mid-Atlantic region.

Insurance Companies May Lowball Your Settlement. So We Play Hardball.

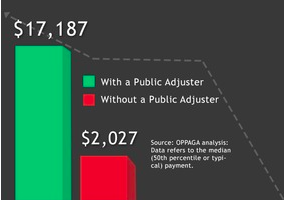

After a property-damaging storm, flood, or fire, the deck is stacked against you. Your insurance company will send in their team of experts: an insurance adjuster, restoration contractor, salvor, cause of origin investigator, and forensic accountant. They often have one goal—to pay out as little as possible. By hiring Shorter Settlements Inc, our licensed public adjusters will go to work for you, and only you, to level the playing field during the insurance claim process and get you the money you are owed.

What Is a Public Adjuster?

Public adjusters are licensed by the state to legally represent the rights of an insured during an insurance claim process. We are advocates for policyholders, not the insurance company. Often, we find that many homeowners and business owners don’t even know about public adjusters; they think the insurance adjuster works on their behalf. And while there are fair and reputable insurance adjusters out there, you should always have someone representing your best interests.

Should I Hire a Public Adjuster?

If your claim is in the five-figure range, hiring a public adjuster protects your best interests because they are employed by you; you pay for their services, so it becomes their job to get you the best settlement as quickly as possible. But beware: not all adjusters are reputable, and there are “ambulance chasers” out there looking to make a quick buck. With Shorter Settlements Inc. you can be confident that you have caring and qualified—and licensed and bonded—public adjusters to help with insurance claims and maximize your claim.